San Diego Trust Fraud Attorney

Assistance with Fraud Cases in Los Angeles & Throughout Southern California

Having all the finances in order prior to a loved one’s death is always the best scenario, as it minimizes feuding over who has rights to what. However, even when prepared years in advance to avoid disputes, wills and trusts can still be changed all the way up until a loved one’s passing.

California law will generally assume competence among elderly individuals and give them the ability to give away money and assets until they die. This can be problematic when elders suffer from cognitive impairment and lack of mental competence, leaving them unable to make decisions and vouch for what they had originally planned.

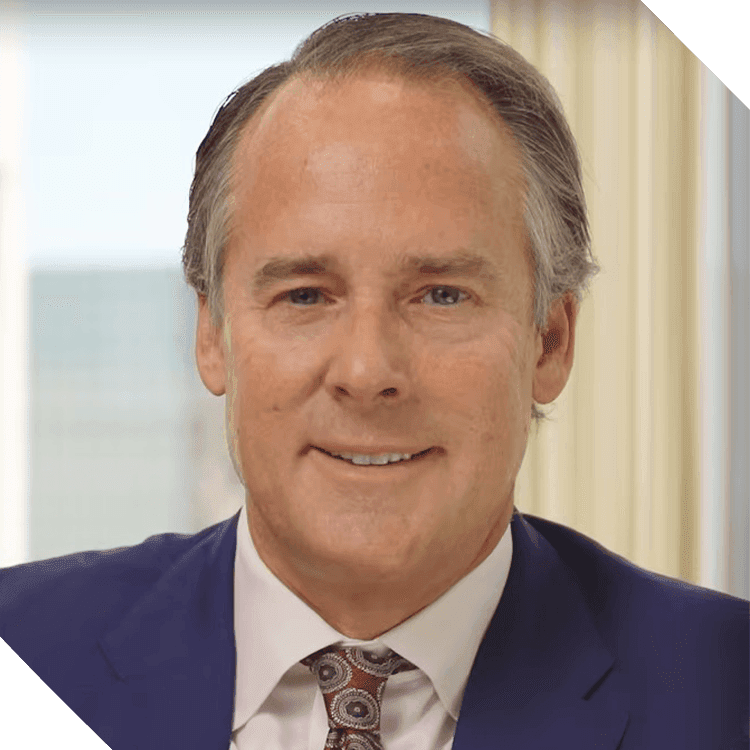

Perpetrators of will or trust fraud often take advantage of an elder’s vulnerable state and trick or pressure them into altering the documents for the perpetrator’s own financial benefit. Fortunately, Attorney Bryant and his team want to ensure that the decedent’s assets are distributed to the right individuals as the decedent had desired when they had full mental capacity.

What Is the Difference Between a Will & a Trust?

A will is regarded as a testamentary document, meaning that in order to be valid, it must meet certain requirements. A will must be signed by the person whose will it is (i.e., the testator), and the signing must be viewed by two witnesses. A holographic will is valid in cases with no witnesses; however, all major terms of the will must be in the trustator’s own handwriting and signed by them. California wills are also never notarized, as it is meaningless. According to California state law, these are the only two acceptable forms of wills.

On the other hand, trusts may be oral or written. However, it is always better to have a written trust, as an oral one can be harder to prove valid. Written trusts must be signed by the person whose trust it is (i.e., the trustor), but that is all that is required to make them valid. For a trust, no witnesses or notarization of any kind is necessary. A majority of trusts are notarized to prove that the individual singing it was the named settlor, but notarization is not a legal requirement for trusts in California.

Can I Sue for Will or Trust Fraud?

In California, there are several types of will and trust fraud. One common type involves a situation where the trustee engages in self-dealing or other dishonest conduct to the detriment of the trust’s beneficiaries.

The trustee owes a fiduciary duty to the beneficiaries and must act in their best interest. If the trustee does not, the beneficiaries can file a lawsuit against the trustee in probate court. In that situation, the beneficiaries can recover monetary damages against the trustee and have the trustee removed by the court and a new trustee inserted.

Common Examples of Trust Fraud

- Trustee fails to distribute trust assets to beneficiaries in accordance with the terms of the trust

- Trustee engages in self-dealing with respect to trust assets

- Trustee fails to make prudent investments with assets

- Trustee refuses to provide to beneficiaries an accounting of the assets

- Trustee commingled trust assets with their personal assets

- Trustee uses trust assets to pay for personal expenses

- Trustee mismanaged trust assets, causing the overall value of trust assets to decline

With respect to wills, the executor or administrator owes similar duties to the beneficiaries. If an executor violates those duties, the beneficiaries can file a lawsuit against the executor. The same type of conduct that constitutes trust fraud also constitutes will fraud.

What Are Indications of Will or Trust Fraud?

There are many indicators that will or trust fraud may have taken place, but most involve a paper trail that can be covered up by the perpetrators after the elder has passed away, making the will and trust fraud harder to discover than other forms of elder abuse or neglect.

However, if you find yourself asking certain questions, like the following, you should look into the possibility of will and trust fraud:

- How did they get so much more money than everyone else?

- Was my loved one really close enough to this person to leave them this much money (or any money at all)?

- Where did all the money in this account go?

Here are some warning signs to look for:

- A close family member (such as, a child or spouse) is excluded or disinherited from the will or trust.

- The trustee or administrator continues to give excuses for delays in responding, communicating, making distributions, or reporting.

- The elderly individual relied on a significant beneficiary for necessities like food, clothing, housing, or medical care.

- The elderly individual abruptly altered their will or trust, usually just before death.

- The trust or will seems to strangely benefit a non-relative, such as a caregiver, lawyer, or accountant over the elder’s actual family or loved ones.

- The elder or another layperson created the will or trust instrument, or it is not properly signed or witnessed in accordance with California state law

- Property is regarded as missing.

- The elderly person gave away substantial amounts of property or money shortly prior to death.

- Someone receives money or other property pursuant to a power of attorney.

- The elderly person altered or created multiple wills or trusts in a short period of time, often just before death.

There are also indicators of will or trust fraud that a forensic accountant may be able to investigate and uncover for you, such as:

- Estate accounts include some substantial credit card bills; however, the deceased individual did not use a credit card, or they were unable to due to their physical or mental condition prior to their death.

- The tax documents for a deceased individual’s bank account reveal a large interest figure the previous year, but the account has a very small sum of money upon their death. This could be an indicator that a perpetrator has stolen money from the account.

- A car or another expensive item was purchased in the deceased’s name; however, they did not or could not use such an item at the time of its purchase, indicating that another person had purchased it for themselves.

- Leading up to the deceased individual’s death, large sums of money were withdrawn from their bank account and given to others in the form of checks, indicating that the perpetrator(s) may have written checks to themselves from the elderly individual for the sole purpose of their own financial gain.

If you find yourself asking these sorts of questions or seeing these warning signs, it is best to consult a skilled elder trust fraud attorney in San Diego immediately.

Another common type of will or trust fraud involves inheritance disputes. In this situation, a perpetrator coerces a person (most often an elderly person) to change their will or trust to benefit the perpetrator. Often, the wrongdoer coerces the elder to make the changes shortly before death or while the elder is in the hospital. In other situations, the wrongdoer exerts undue influence (excessive persuasion) on the elder to get them to change their will. Elders with Alzheimer’s disease or another type of dementia are very vulnerable to undue influence.

If the event of trust fraud, the trustee or a beneficiary of the valid trust must promptly file a trust contest to invalidate the fraudulent trust in probate court prior to the statute of limitations’ expiration. The statute of limitations can be as short as 120 days. Similarly, with will fraud, the executor or a beneficiary of the valid will must promptly file a will contest to invalidate the fraudulent will, and the statute of limitations can be even shorter. That is why it is very important to contact an attorney with experience handling financial elder abuse cases immediately if you suspect that a friend, relative, or family member has been coerced or unduly influenced to change their will or trust.

Similarly, inheritance disputes may arise due to conflicting interpretations of multiple wills or trusts signed by the elder, or due to disagreements regarding the interpretation of confusing or complex language in a trust.

If your loved one changed their will or trust because they were misled, pressured, or under undue influence, or if they have lost assets or property due to conservator or trustee fraud, Joel R. Bryant can help you.

Attorney Bryant can offer you skilled, highly experienced legal help for any of the following situations:

Wrongful Change or Addition to a Will or Trust

A change or addition is wrongful when there is pressure, lying, or taking advantage of an elder’s confusion, so the abuser ends up in line to inherit most or all of the assets. Attorney Bryant can help whether the elder is still living or has already died and the will is being probated or the trust is being distributed.

Conservator Fraud or Theft

The conservator breaches their fiduciary duty and steals or makes favorable deals for themselves from the elder’s assets or real estate. Attorney Bryant help recover assets and seek reimbursement from the conservator.

Trustee Fraud or Theft

The trustee steals money, assets, or real estate from a trust set up to benefit the elder person. Joel R. Bryant can help you recover assets and seek reimbursement from the trustee.

Contact us online or call (619) 597-2577 for assistance.

In Their Own Words

-

"Mr. Bryant and his staff were always available to answer our questions and concerns."Eugenia A.

-

"Joel used creativity and attention to details of complex corporate matters to move the case to settlement within six months of filing."Robert H.

-

"They were very professional, honest, compassionate, and supportive."Brent R.